Q1 2022 will see some inflation YoY because of an increase in revenue from sectors such as travel which weren’t spending in Q1 2021. Viewing is also predicted to be down as we are out of lockdown and continuing the trend from Q4 2021.

With higher demand from brands during the Christmas period and a post-Christmas drop in TV viewers – inflation is likely.

The impact of early Christmas campaigns

This year, Christmas campaigns have been broadcasted earlier than usual, with Boots launching their “Bags of Joy” TV advert as early as November 4th, and online retailer Very dropping their campaign 85 days early on October 1st.

The early Christmas campaigns and increasing advertising demand meant that October 2021 was quickly set to be one of the biggest trading months to advertise on linear. As TV pricing fluctuates due to supply and demand – this increased competition combined with a decline in TV viewers is likely to result in inflation.

Prices expected to increase

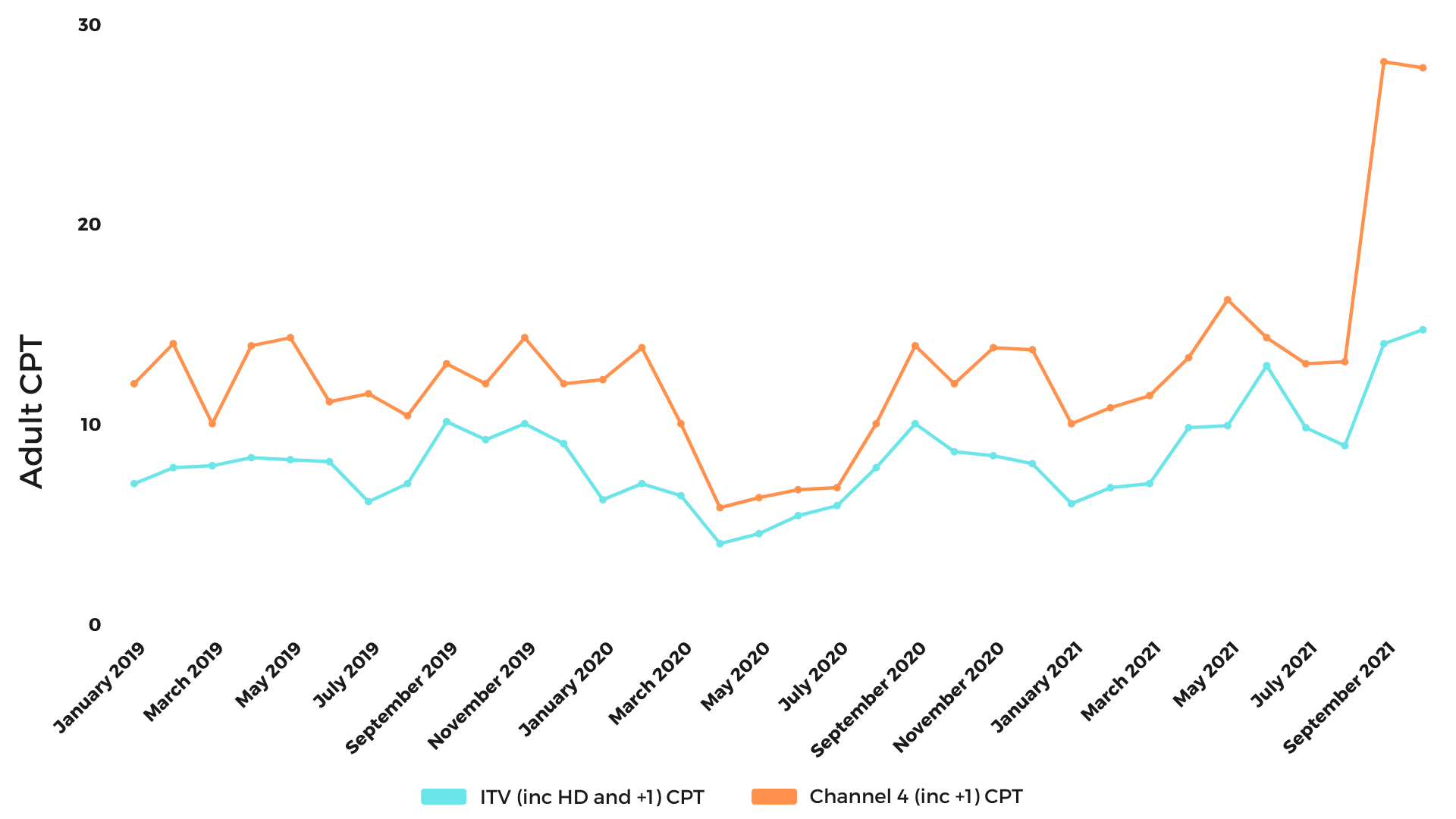

Figures from BARB show that while CPT decreased over summer 2021, the Christmas demand is taking its toll much sooner than usual when looking at previous years – and prices are estimated to continue to increase following the post-Christmas period.

Adult CPT prices 2019-2021

The competition in the TV landscape is high, and there is sense of momentum building – more brands are returning to TV advertising as the country has emerged out of lockdown through the year. So, as we sit now at the end of the year with almost no restrictions, there are a lot more brands and categories active.” (Source: Mediatel).

“Viewing is also predicted to be down as we are now out of lockdown and continuing the trend from Q4 2021. “

Helen Grey

AV Account Director

New to TV advertisers

Last year was a ‘different’ year for all TV advertisers, with many of the UK’s big names freezing their TV and online marketing budgets during the lockdown. This essentially opened the door for smaller businesses to make their first TV appearance, as the price of airtime was lower than it had been in over three decades.

With CPMs right down at the beginning of the pandemic, over 1,200 brands that were either new to TV advertising or had been away for a year or more, were back in the landscape.

Moving forward, as we come out the other side of the pandemic, TV continues to be a popular advertising medium, with linear remaining at the top but streaming usage rising, especially amongst a younger audience. This is likely due to people having more free time at home, combined with the accessibility of box sets and movies, for quite a low price.

“Previously only the under 25s spent more time watching SVOD than TV. This data shows that the trend is moving up the age scale. The over 45s are still watching considerably more TV than subscription VOD, which is good news for many of our clients. “

Ed Feast

Planning Director

Will advertisers shift to other media?

Some advertisers were “caught by surprise” by the September 2021 TV ad market surge (Source: Campaign live), but the TV market has still boomed this year and some advertisers are recording notably high revenue.

ITV, for example, is on track to “record the highest ad revenue in its 66-year history.” ITV’s video-on-demand alternative, ITV Hub, has also recorded an impressive 54% growth in revenue to the end of September, when compared against the same time in 2020 (Source: Mediatel). ITV benefited from an increase in video viewing from homebound consumers last year, plus CPMs dropped.

However, analysis from Berenberg suggests that ITV is one advertiser that could face risks from this pricing inflation, largely because of their “lack of progress” with Britbox. Berenberg state that “the price of advertising could result in marketers shifting to other media” as cost inflation takes hold.

FEATURED READS

Despite concerns, over the past year, the TV industry has “matured in the face of its challenges, becoming an even more useful, agile and data-driven medium for marketers in the process” (Source: AdAge) and advertisers do continue to reap the benefits of TV.