With rising inflation and increased cost-of-living concerns, UK households are increasingly looking for ways to budget, and the SVOD market is feeling the effect.

Kantar’s Entertainment on Demand study found that 1.51 million SVOD services were cancelled by UK households this quarter, compared to 1.04 million in Q4 2021, and 1.20 million in Q1 2021. Many consumers are prioritising budgeting where they can as they have less disposable income.

Saving money is the priority for UK households

UK inflation increased to 7% in April – the highest rate it has been for 30 years, and a combination of surges in the price of fuel, energy and food are putting pressure on household budgets. Kantar found that almost half (38%) of households intend to cancel a subscription due to “wanting to save money”.

For the three months leading to March 2022, just 3% of GB households subscribed to a new SVOD service, compared to 4.2% in Q1 2021. SVOD penetration amongst GenZ households also fell for the first time, decreasing from 75.8% in Q4 2021 to 74.6% in Q1 2022.

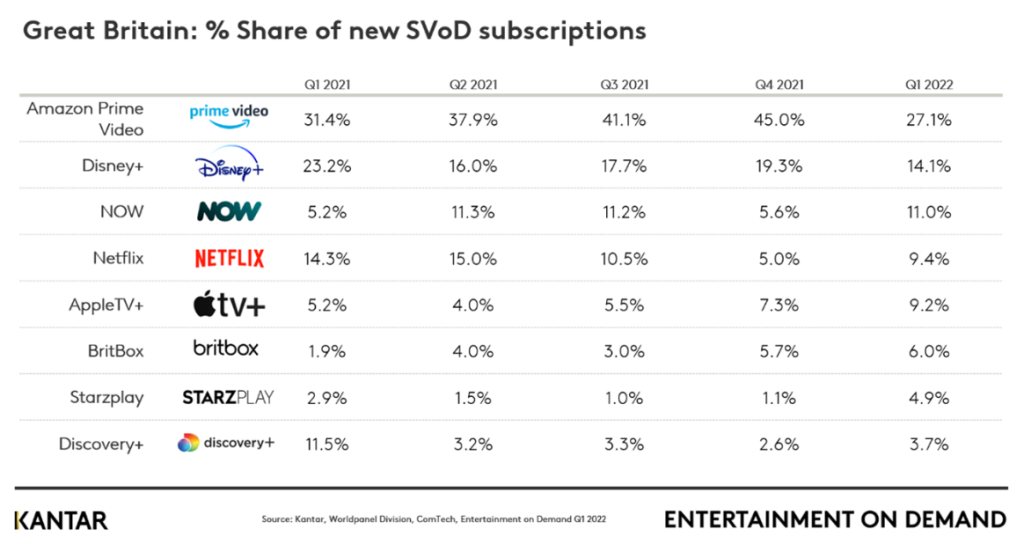

Although churn rates for streaming platforms increased due to inflation, it seems Netflix and Amazon were the last to go for most households. Amazon Prime also has the highest number of new UK subscribers.

Disney+, NOW, Discovery+ and Britbox saw significant churn rates this quarter compared to the last, with Disney+ tripling its quarterly churn to 12%.

GB % share of new SVOD subscriptions

Attitudes to adverts are softening as a result

The study found Netflix subscribers’ attitudes to advertising were “softening” with 44% now saying they “don’t mind” seeing ads on streaming services if it makes them cheaper, up from 38% at the same time last year.

As SVOD providers explore strategies to increase revenue, advertising could be an obvious route for driving that growth. It is, however, also a route that many big streaming platforms such as Netflix and Disney+ have historically shied away from, up until recently…

Streaming giants to launch ad-funded model

Netflix and Disney+ are set to launch ad-funded options to reduce the cost of subscription in a battle to turn around the recent decline in growth. Amazon Prime are also currently recruiting heavily for their Streaming Advertising team, which is an indication of things to come.

All Response Media Viewpoint

“It’s unlikely that the drop in subscribers will be as harsh or as immediate as the research suggests, as people often say they’ll do something, and then don’t. That said, there is almost certainly going to be a reduction in overall subscribers paying full whack. There are a few potential scenarios here…”

Ed Feast

Planning Director

- The SVOD suppliers offer a partial, or fully ad funded option. This could slow the decline, or even reverse it, by opening it up to a broader range of households. It might also help to address the password sharing which goes on. If this happens, the TV market is unlikely to benefit.

- SVOD suppliers continue to charge for their content, or their partial ad funded option isn’t that good. This could cause an acceleration in people leaving their paid VOD subscriptions. The question is whether people would drop back into linear TV viewing and increase the supply of impacts in the market which could lower the price for advertisers, or move into the free BVOD options offered by the broadcasters. Moving into BVOD would be best for the broadcasters due to the premium that they can charge…whereas linear would be better for advertisers.

- Nothing changes at all. This is the least likely opportunity because it would require all players to hold their nerve, but with share prices tanking as subscriber numbers drop, it would take balls of steel to do nothing. Netflix share price has halved this month.

IMDb TV streaming service rebrands as Amazon Freevee

As cutting down on household expenditure is now a priority for many UK households, Amazon Freevee could be a popular alternative to Netflix and Now TV.

FEATURED READS