Looking back to look forward

“The pandemic significantly impacted all advertising industry revenue. We saw revenues in the commercial TV sector materially decline almost overnight, as advertisers either cancelled or postponed their campaigns in light of the pandemic.”

Aldona Cornish

Director

2020 was a year marked by the Covid-19 pandemic, and lockdown restrictions were put in place to reduce the spread of the virus.

A timeline of lockdown restrictions across the UK

How revenues fell by media channel in 2020

The Advertising Association and World Advertising Research Centre (AA/WARC) Expenditure Report, which covers advertising revenue data across the entire media landscape, indicates that total UK advertising revenues declined in real terms by 8% in 2020.

During 2020, commercial television broadcasters were able to successfully increase advertising revenues from their video-on-demand services (e.g. ITV player, All4 and My5), and this somewhat compensated for the decline in traditional linear TV advertising.

FEATURED READS

The 2021 bounce-back

Initial forecasts from the World Advertising Research Centre (WARC) suggest that the UK is on course to achieve the fastest ad trade recovery of any major European market this year, and one of the strongest growth rates across 100 global markets.

Advertisers’ caught by surprise’ by September TV ad market surge

TV market is set to end 2021 well ahead of 2019.

The latest AA/WARC Expenditure Report, predicts that UK adspend will grow by 18.2% in 2021 to reach a total of £27.7bn. This is an upward revision from the 15.2% rise forecast in April. Early WARC predictions for 2022 UK ad spend suggest 8 to 10% on 2021.

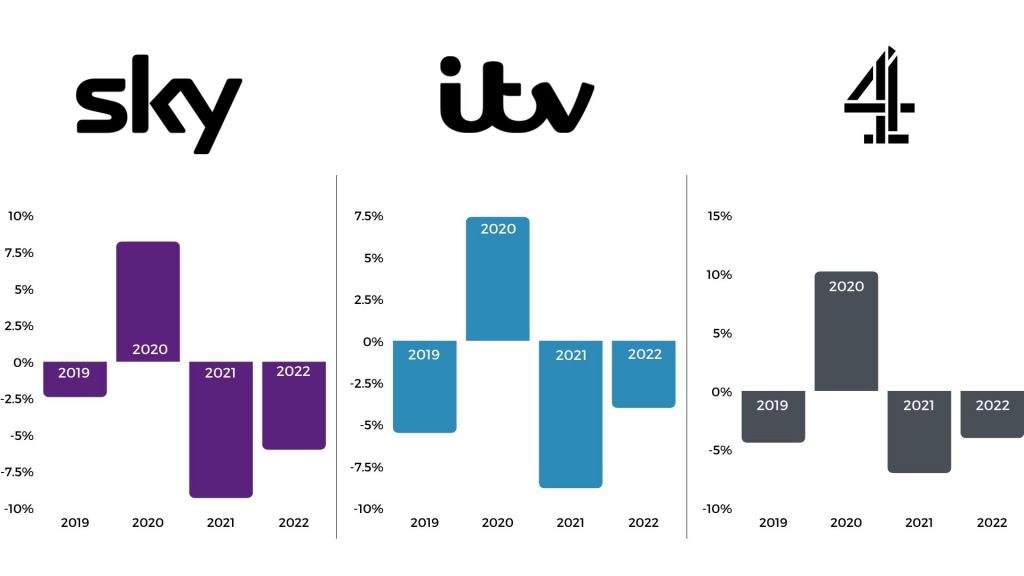

YoY Revenue by Saleshouse: 2019 to 2022

2021 revenue vs. 2019 revenue (pre-Covid) was up for ITV by 21%, Channel 4 by 20% and Sky by circa 12%. We can expect revenue to be up for each Saleshouse in 2022 – our current estimations put this at circa 3-5% on 2021.

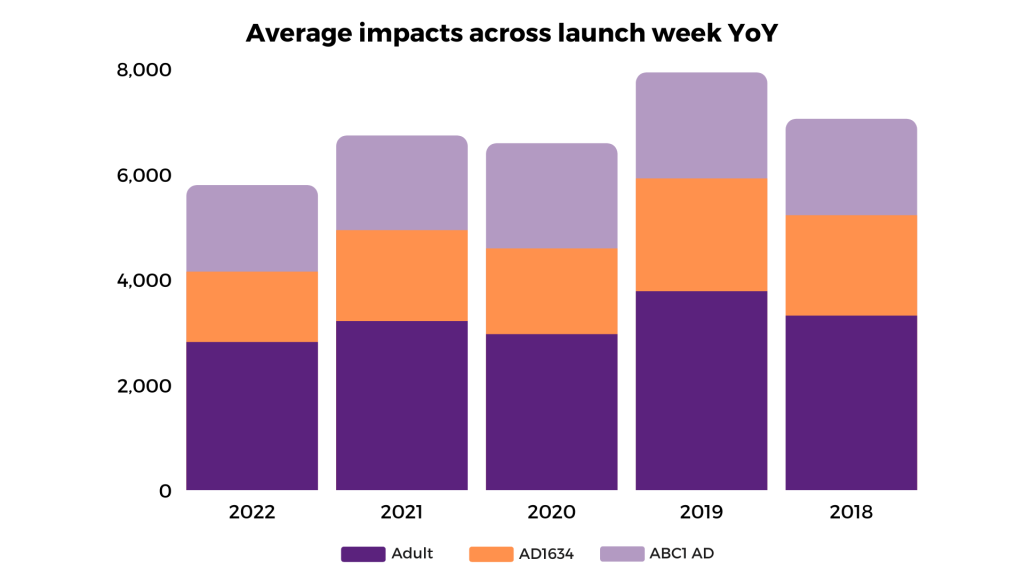

YoY impact performance: Adults

(2022 = ARM estimate)

In 2020, C4 Owned stations had the highest growth in adult impacts vs. Sky & ITV at 10%. However as people returned to work in 2021 and impacts fell, ITV has seen the largest decline closely followed by Sky.

YoY impact performance: Adults

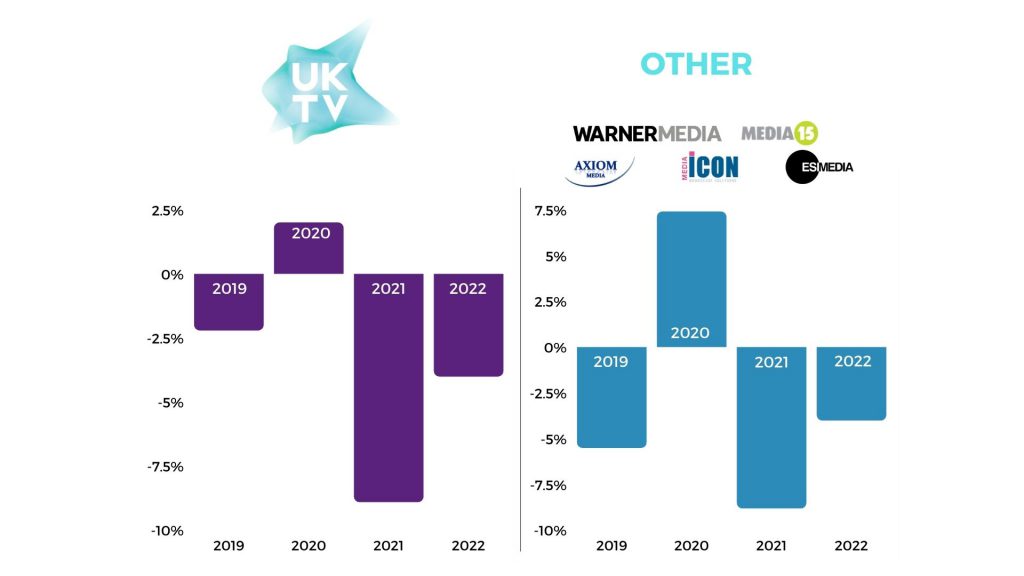

(2022 = ARM estimate)

2021 impact declines across the smaller stations has been less pronounced, however these stations carry high volumes of zero-rated spots compared with terrestrial counterparts.

Market trends shaping the year ahead

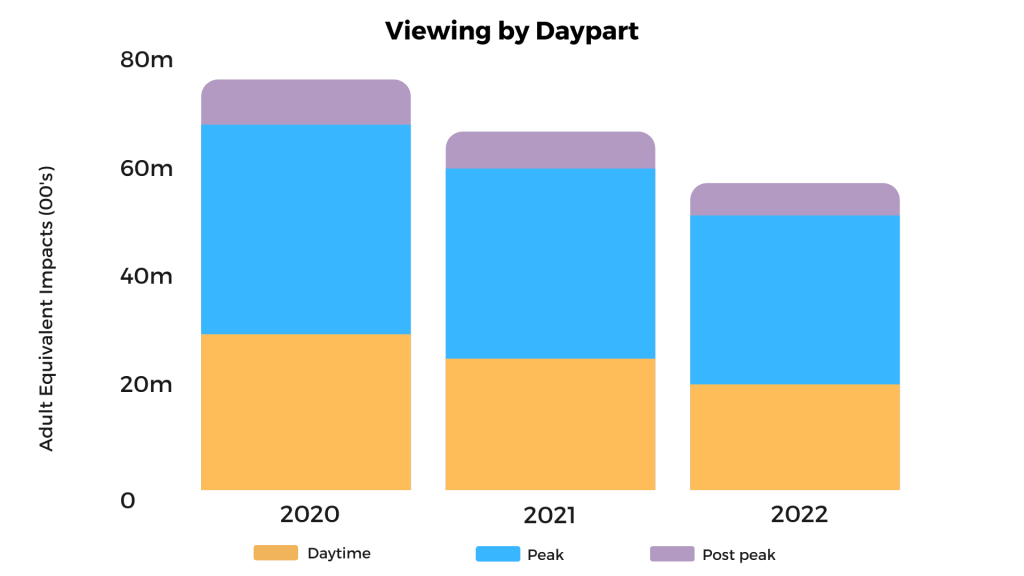

- Whilst 2022 lockdowns aren’t anticipated, the UK has recently moved to work from home advice, which is likely to have an impact on increased TV supply in the short term.

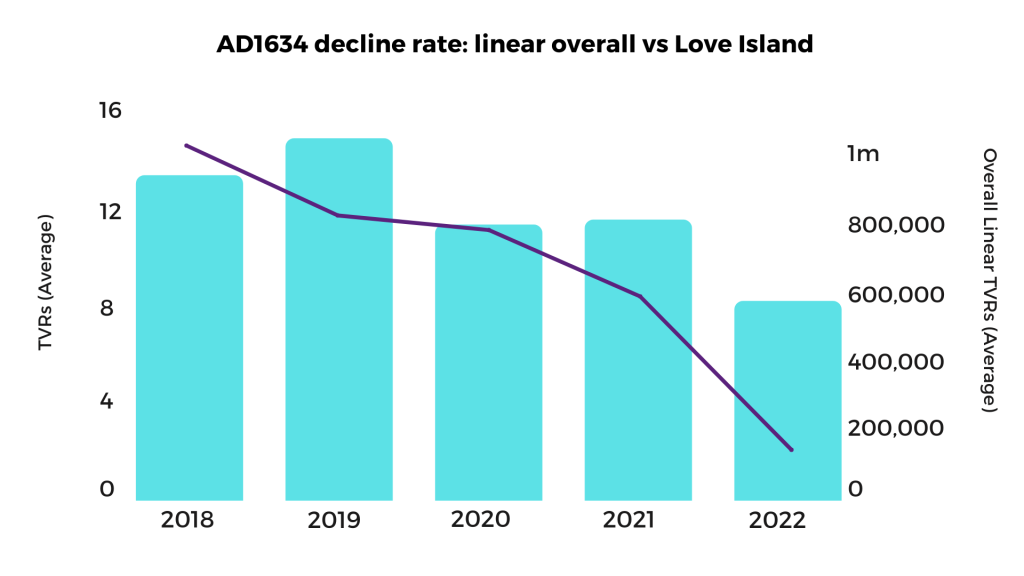

- Whilst Adult linear impacts are expected to decline further in 2022, this is largely driven by 16-34 impact migration (to video-on-demand) as opposed to 45+ adults.

- 16-34 linear impacts will continue to feel pressure with continued migration away from linear TV and to video-on-demand viewing.

- Aside from the late winter World Cup, there is a lack of event led programming in 2022 for those advertisers seeking brand reach.

- Government spending remains a key growth area, supporting the Covid vaccine rollout and other related initiatives.

- The travel & transport sectors, although somewhat still affected by uncertainty, will see an increase in demand.

FEATURED READS

2022 planning guidelines

- Advisable to account for a 10% inflation buffer on daytime TV pricing for initial 2022 planning purposes – whilst our daytime pricing is largely fixed, we will want to mitigate any inflationary impact as much as possible during our negotiations.

- Peak and All-Time pricing as part of a floating mechanic, will be subject to market conditions – in these instances we are initially estimating 2022 annual inflation to be the following:

- ABC1 Adults: + 12%

- 16-34 Adults: +20%

- 16-54 Adults: + 15%

- HP + CH: + 20%

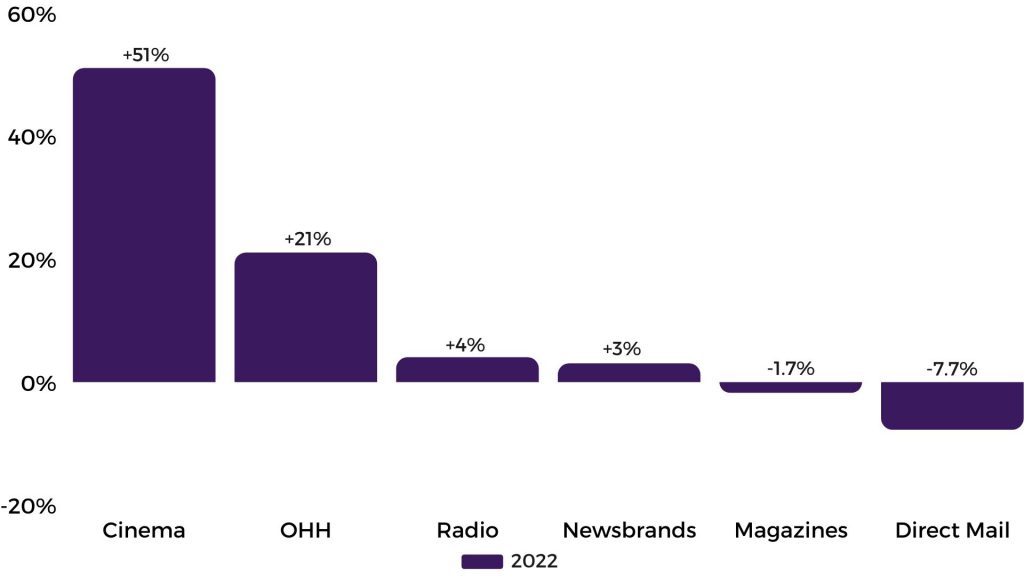

Other Media: 2022 predicted revenue changes

After taking a hit during lockdown, findings from The Advertising Association/ WARC Expenditure Report suggest that Cinema will be up by +51% revenue in 2022.

Market trends shaping the year ahead

Press

- Newsbrand revenue is predicted to be marginally up in 2022, but much of this is being driven through digital as opposed to print revenue.

- Print product – some publishers continue to run efficiently as possible through reduced paginations, somewhat reducing the opportunity for short term deals.

- Publishers such as Future have said we can expect more titles to move to a digital only distribution method as they continue to build the brands in an online environment.

- Gives rise to the opportunity to build deals around online and offline and apply valuable first party data, presenting a growing alternative to social media platforms.

Radio

- 2022 radio predictions will very much be predicated on the release of updated RAJAR data expected at the end of Oct ’21. Radio listening has not been independently measured since the start of the pandemic as face-to-face surveys could not be carried out.

- It could highlight some quite big changes as potentially people move to more digital devices to consume radio, or it could show a fairly stable listening pattern.

- Much like the rest of the industry, 2020 was tough for radio and revenue declined by circa 16%, however as with TV it has recovered well in 2021 and is estimated to finish at +16.9%.

- 2022 is looking to continue this growth and initial estimates forecast it to grow by circa 3% on 2021.

FEATURED READS